We Are Your Restaurant Finance Experts

Financing can help you stock your kitchen for success

Financing can help you stock your kitchen for success

If You Sell Equipment, We Want to Help You Finance It

There is no cost to join our Vendor Program, and the benefits are clear. Our team makes offering lease financing easy and effective.

Why Choose TimePayment?

Increase Sales With Financing

Our finance programs are designed to empower businesses of all sizes and strengths, including new entities. We can help the customers other financial institutions refuse, with transactions starting as low as $500.*

Close Faster & Get Paid Faster

For transactions above $25K, you will receive a credit decision within 4 hours. Same-day funding is available; receive your payment after transaction closure.*

Approve More Businesses

TimePayment has programs for a wide range of business and ownership backgrounds—from pop-ups and mom-and-pop shops to decades-old, multi-location eateries. We can even help businesses with challenged credit.*

Experts in the Restaurant, Bar & Food Industry

In an environment where most financing companies shy away from restaurants and bars, TimePayment has a long-time commitment to your industry.

*Some exclusions apply.

Equipment We Can Finance

Bar & Beverage

Commercial Blenders

Coffee & Tea Brewers

Espresso Machines

Draft Beer Dispensing Systems

Drink Fountains & Soda Guns

Underbar Ice Bins/Cocktail Units

Hot Water Dispensers

Beverage Coolers

Water Filtration Systems

Nitrogen Beer Tap Systems

Cooking Tools

Commercial Ovens

Griddles & Grills

Deep Fryers & Fryolators

Panini Presses & Toasters

Crepe Machines & Waffle Irons

Commercial Microwaves

Ranges & Range Hoods

Rotisserie Ovens

Charbroilers & Smokers

Ice Machines

Walk-In Freezers

Chest Freezers

Walk-In Coolers & Lockers

Reach-In Refrigerators

Coolers & Glass Frosters

Wine Storage Chillers

Humidors

Point of Sale Systems

Signage

MICROS Systems

Restaurant Furniture

Lighting Fixtures

Accounting & Payroll Software

Televisions & Audio Systems

Restroom Vending Machines

Hand Dryers & Laundry Machines

Cleaning Equipment

And More…

Benefits for You & Your Customers

Increase Sales Faster with Equipment Lease Financing

TimePayment makes your equipment easier to buy. Our innovative tools integrate simply into your website and sales processes so you can sell more, faster.

Your customers can establish and build business and personal credit.

Generate revenue from newly financed equipment while it pays for itself.

Your customers’ business equipment purchases could be tax deductible. Customers are encouraged to talk to their tax professional.

Your customers can keep their cash on hand for essential business needs.

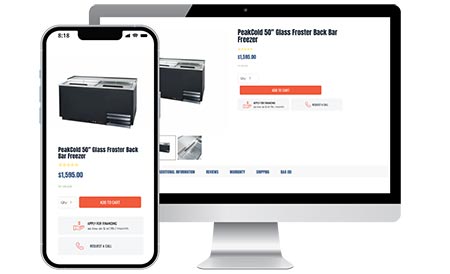

Technology For Every Platform

Ready to Get Started?

With rapid credit decisions, a clear online process, and comprehensive funding within hours, we have programs that can support your customers.

What We Hear From Customers

“The salespeople say my equipment purchases are too small for financing, so I usually have to use cash or credit cards for equipment under $10,000.”

“Financing companies are not able to meet the needs of the $20,000 Furniture, Fixtures, and Equipment (FF&E) for restaurants. Banks think that deal size is beneath them… We lose business because we can’t offer financing on 70% or more of our invoices.”

It can seem like banks and other financing companies ignore many of the FF&E deals for the restaurant industry, especially when the average deal size is below $20,000. Not TimePayment. We want your business, we have financing programs that start at $500, and we can help you find a way to finance most of the equipment you need.

Contact Us: Restaurant & Franchise Vendor Support

Our custom funding programs enable equipment sellers to turn one-time transactions into long-term relationships. Our platform provides financing solutions to turn up-front costs into simple monthly payments.